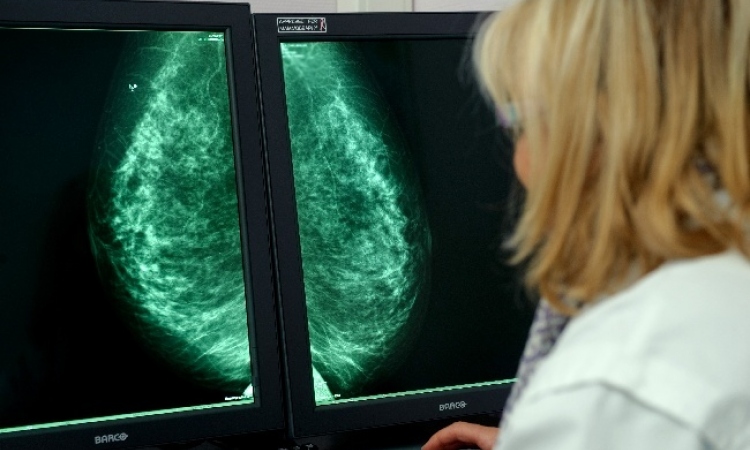

The switch from analogue to digital

A boon for Europe's mammography market

Analogue screening systems are gradually being replaced by digital mammography systems, and breast cancer screening programmes are increasing sales. The majority of European countries have implemented in European countries, but in some others their introduction is slow, but steady. Additionally, Europe has significant geographic diversity, and remote places served by mobile screening units generate greater public awareness of the benefits.

‘The implementation of mobile screening units will generate more awareness in distant places,’ says research analyst Smruti Munshi, in a new study from business consultancy Frost & Sullivan, which examined the European mammography systems market*. ‘In Europe, the trend is that of the mammography system going to the patient and not the patient coming for a mammogram, creating potential for market expansion.

‘With an increase in mobile solutions, mobile screening will penetrate rural communities and improve their access to screening,’ he adds. ‘Telemammography will enable the transmission of digital mammograms from one location to another for expert consultation. Additional tests, if required, can be conducted immediately with mobile digital mammography. Mobile units are also being used in hospitals in emergency rooms and operation theatres. The implementation of widespread screening should lead to increased mobile unit sales in the future.’

Reasons for delayed uptake of digital mammography implementation are mainly budgetary constraints and socio-economic factors, but also include some governments’ policies, e.g. they still demand film reading (such as in France).

‘Mammography vendors should lobby governments of individual countries, where screening is yet to be implemented,’ Munshi suggests. ‘Reimbursements are also very vital for market expansion. Lobbying should aim at promoting the reimbursement of the treatment rather than the diagnostic tool. Joint efforts with various advocacy groups such as women’s rights groups and cancer therapy groups will be vital for market advancement.’

The study focused on the full-field digital mammography (FFDM), Analogue mammography systems, diagnostic mammography systems and computed radiography markets, and reveals that these earned revenues of US$219 million in 2007 – estimated to reach US$346 million in 2014.

‘In the diagnostic market,’ Smruti Munshi points out, ‘the more advantageous and efficient prone biopsy units are showing more potential for growth, because of their enhanced ability to provide biopsy guidance. Moreover, prone biopsy units offer a cost advantage over add-on upright systems.’

*Report: European Mammography Systems Market M290.

Details: www.medicalimaging.frost.com

01.05.2009