There’s no meteoric rise to the clouds for medical images

For technology suppliers the potential return on investment in medical images storage via cloud computing will not be lightning fast, market analyst for healthcare IT Theo Ahadome told EH correspondent Michael Reiter

When assessing the market for cloud technology in medical imaging, InMedica* market analysts found that cloud business models fall primarily into the realm of ‘managed services’ delivery: a vendor manages the IT infrastructure, providing service level management, and application as well as system administration, taking on responsibility for maintaining this infrastructure, including the data centre/storage, housed locally or remotely. Benefits include reduced need for capital investment, such as costly in-house IT support staff and IT infrastructure. It also provides regular access to the latest software upgrades and allows flexible storage capacity to suit end user’s needs, according to Market analyst Theo Ahadome.

So, how does cloud technology in medical imaging work?

‘There are numerous forms of managed services depending on the location of the two components of imaging IT: software/application and storage,’ he explained. ‘Cloud storage refers to where the storage/data centre is hosted by the vendor or third party, as in the managed hosting and Software as a Service (SaaS) off-site models. The application, such as PACS or vendor-neutral archive (VNA), may also be cloud-based, such as in SaaS off-site and SaaS onsite models. Only SaaS off-site offer full hosting for both application and data centre, and may hence be considered the true ‘cloud’.’

The potential for healthcare organisations

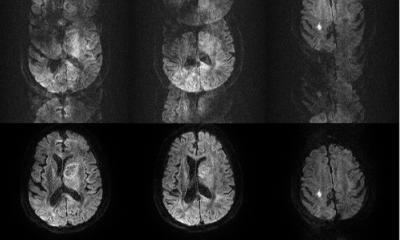

‘As the amount of data generated rapidly increases in various industries, so too does the need to provide safe and affordable storage solutions. Cloud technology, by enabling scalable storage, reducing upfront costs and facilitating data sharing, has risen to the challenge; it can do the same for healthcare. Within the sector, medical images account for the majority of data generated. As procedural volumes grow from X-ray, CT, MRI, ultrasound, and other modalities, medical images have become the largest driver of growth in healthcare data. Increasingly, further image-generating departments, such as cardiology and pathology, are becoming digitised. ‘Cloud technology has the potential to reduce the costs to healthcare organisations of storing and managing this large growth in data. It also allows hospitals to consolidate images from different departments into a central archive, in lieu of the departmental silos in which they currently reside. This gives hospitals greater oversight of their data and facilitates the sharing of this data.’

What does he consider to be the key barriers to embracement? ‘Key barriers include data security – strict procedures and regulations govern storage and access of sensitive patient data,’ he explained. ‘It’s therefore significantly difficult for a hospital to hand over this data to a third party to host via a cloud-based model. Further barriers are performance concerns, budgeting systems, vendor lock-ins and data migration costs. Hospitals that have the capital budget to purchase long-term image management and storage solutions upfront are less inclined to shift to a payas- you-use model without understanding the long-term difference in costs and benefits. There is currently a lack of data on this ROI.

How is implementation progressing in Europe? ‘In 2011, managed service business models accounted for about 25% of radiology PACS revenues,’ the analyst explained. ‘However, cloud technology “cloud” – SaaS and managed hosting services – accounted for less than 5%; by 2015, this is projected to increase to only 10%, due to the security, performance and ROI concerns. The UK and Ireland, Benelux, and France lead Europe in terms of managed service penetration, including cloud-based models. Germany has been slow to adopt such models due to strong concerns about data privacy. Conclusion? ‘Until the notion of vendor hosting in terms of security, regulatory compliance, performance, end-user trust, and ROI are met, the adoption of cloud technology will continue to be slow.’

10.07.2012