Financing the future of European healthcare

Modern financing approaches, such as public-private partnerships (PPP) and asset finance, are necessary to meet the challenge of affordability in healthcare systems today, writes Mike Treanor, Managing Director, Siemens Financial Services (SFS) GmbH, Munich

Siemens Financial Services (SFS) recently published an international white paper focusing on the financing of European and US healthcare systems.

Our aim was to offer professionals in the field some metrics and fresh perspectives on the issue at a time when the minds of many strategists are occupied with the viability and sustainability of national healthcare systems. One of the key conclusions from our study is that flexible capital is absolutely critical to the timely provision of modern healthcare equipment, technology and IT – but that a substantial proportion of capital is currently ‘frozen’ in European healthcare systems because it is not effectively or efficiently deployed.

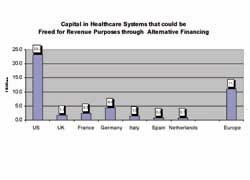

We defined ‘frozen’ capital as capital funding that is radically out of step with the purposes to which it is being applied, and is therefore not delivering value for money. On this basis, we calculated that the main European economies are tying up some ?10 billion or more of capital (see Figure 1). The main cause of this is the old-fashioned practice that dictates that technology and equipment should be owned, at a time when the pace of technological change has placed a major question mark over the advantages of actually owning capital equipment. In reality, the two main areas of capital equipment that we study in our report – major medical devices and IT - are prime candidates to be leased, or acquired through other asset financing techniques.

The report suggests that if this frozen capital were transferred into asset-financing plans, then healthcare financing could start to provide more modern technology and equipment. Such plans would mean that the organisation would be charged an equipment lease/rental and maintenance cost against revenue budgets, which would reduce longer-term outlay because the asset financier would retain title to the equipment and dispose of it at the end of the lease. At the same time the healthcare provider would enjoy the efficiency benefits of current technology and have the option of refreshing older equipment with modern whenever attractive to do so.

The call for wider usage of asset financing can also meet the demand for costs to be in line with actual equipment utilisation through payment -per-usage structures, where assets are rented or leased on the basis of a fee per unit of utilisation.

Modern financing methods therefore can enable organisations to upgrade to superior new technology at their discretion, without an increase in rental payments or expenditure of scarce capital budget, and can also pass to the financier the risks of disposing of older equipment and of the level of utilisation of the new equipment.

The potential for modern financing techniques to accelerate the introduction of modern technology to the healthcare industry is just one area highlighted by our in-depth study. We conclude that although some areas of healthcare costs require structural, long-term solutions, others may be addressed in a more immediate fashion with available finance solutions. The private sector (and not just the private medical sector) is already aware that it no longer makes sense to buy depreciating assets outright – and public health authorities should follow their example.

Two best-practice examples:

Germany: Hire-purchase

The Medical Centre Dr Neumaier and Colleagues, in Regensburg, Germany, offers its patients diagnostic options that extend far beyond traditional methods of treatment. More than almost any other medical specialists, radiologists rely on the latest technological equipment. This is why, as early as five years ago, radiologist Dr Neumaier decided to finance imaging systems through Siemens Financial Services. He has chosen this financing method over and over again.

His most recent investment is the latest generation magnetic resonance tomography (MRT). The Magnetom Trio scanner from Siemens Medical Solutions offers an extremely high magnetic field force (3-Tesla), which produces unprecedented quality and, as a result, assures the diagnostic usefulness of the MRT images. Patients then can receive the best possible treatment, and the number of patients can be improved.

‘I think it is very important for as many people as possible to benefit from medical progress,’ said Dr Neumaier. ‘It is important to us that we receive the technology and financing from a single source. This particular deal was structured as a hire-purchase arrangement where ownership transfers to us at the end of the financing term. As such, the equipment is immediately on our balance sheet so that we can claim all available tax breaks and allowed depreciation. The customary fast and smooth handling of our financing requests and the option of financing the value-added tax gives my practice much-needed budgetary freedom. As a doctor, this allows me to concentrate even more closely on my patients.’

France: An ‘Operating Lease’ arrangement with upgrade flexibility

The Centre d’Imagerie Médicale Sainte Marie, based in Osny, has financed its major equipment purchases through Siemens Financial Services since 1994, spanning MRI scanners, ultrasound, radiology equipment, and more. As an independent imaging centre, obtaining equipment out of capital expenditure would not have been economical. ‘Today, in the private medical sector, the use of asset financing, and particularly operating leases, is becoming increasingly standard,’ said the Centre’s Director, Dr Valentin. ‘We are a specialist organisation, and so it is imperative for us to offer the highest quality imaging capabilities using the very latest equipment. We were the first organisation in France to acquire a multi-slice MRI scanner. But we have no desire now to own this equipment, just to have use of it to provide the services we offer.’

François Yon, Financial Director of the Centre, added: ‘Operating leases are the ideal financing vehicle, especially since we wrap up equipment, maintenance, insurance, and so on into a single 360° arrangement that ensures that we have a reliable fixed monthly outlay. We also remain free to upgrade or change our equipment if – as happens – a technological breakthrough occurs, rather than being burdened with having to get rid of obsolete equipment. This kind of financing is simple to understand, and flexible in the face of change. Also, when compared with other financial methods, it remains competitive.”

08.03.2007