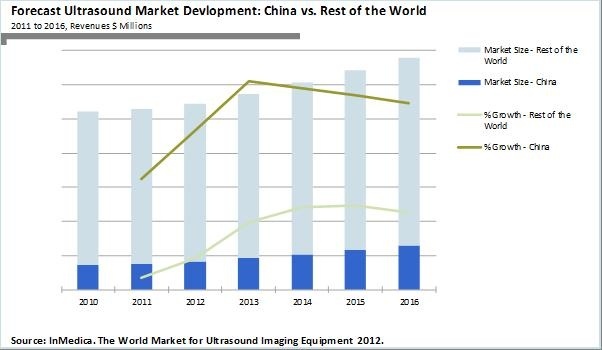

China to Account for One Fifth of Global Ultrasound Revenue by 2016

Following a period of vast investment in healthcare, the outlook for China’s ultrasound imaging equipment market remains very positive. A new report from InMedica, part of IHS Inc. (NYSE: IHS).

The Chinese Ultrasound Equipment Market – 2012 cites recent public health investment from 2009 to 2011 as merely a stepping stone in China’s healthcare revolution. Consequently, revenues generated from Chinese sales of ultrasound are forecast to represent close to 20 percent of global revenues by 2016.

The three-year Chinese government healthcare reform drove rapid growth in unit shipments of ultrasound between 2009 and 2011. Growth was most evident in simple value and low-end ultrasound systems (average selling price less than $30,000), a combination of government targets to provide low-cost healthcare for rural regions, and increasing competition and influence of local Chinese suppliers. Combined with further growth in premium and high-end equipment in the top Tier 3 hospitals, China experienced revenue growth of 8-10 percent annually.

In 2012, there seems to be little evidence of the market hitting saturation; in fact, revenue growth is forecast to increase to a compound annual growth rate (CAGR) of 11 percent over the next five years. “While the volume of lower-value ultrasound equipment is forecast to decline significantly, a dramatic shift in demand for higher value colour equipment in Tier 1 and 2 hospitals will drive strong revenue growth,” commented Stephen Holloway, senior analyst at InMedica. “Public investment in Tier 2 county-based hospitals, to produce regional centres of excellence, will also increase demand for mid-range ultrasound equipment. Intriguingly, this market should experience stiff competition between local Chinese suppliers now producing higher specification systems, and multinational suppliers looking to expand into new markets.”

22.08.2012