Article • Telemonitoring

Driving the mhealth market for many years to come

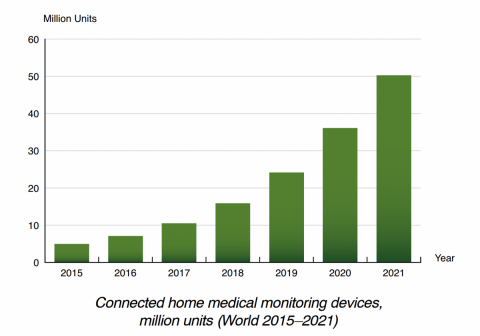

Over seven million people were using remote monitoring in 2016, mainly for cardiac rhythm management (CRM) and sleep apnoea therapy. The number of users will soar as they can increasingly connect to servers and clouds, Swedish analyst Anders Frick predicts.

Report: Mélisande Rouger

About 7.1 million patients were enrolled in mHealth care programs, in which connected medical devices are used as part of the care regimen to monitor patients remotely, as of 31 December 2016, according to a recent report from the Sweden based M2M/IoT market research firm Berg Insight. The firm also estimated that the number of remotely monitored patients would grow at a compound annual growth rate (CAGR) of 50 percent to reach 50.2 million by 2021. mHealth is growing fast, but these figures are still a long way from what the market could look like if every potential patient were using the available technology, according to Anders Frick, senior analyst at Berg Insight. ‘We have estimated that more than 200 million people around the globe would benefit from remote monitoring, so seven million is actually still a pretty small number,’ Frick told European Hospital.

CRM and sleep apnoea therapy

Most commonly used remote monitoring solutions are currently focusing on CRM and sleep apnoea therapy. In terms of revenue, these areas generated €5.1bn in 2016, and names like Medtronic or ResMed have become references. All areas included, remote monitoring generated €7.6 billion in 2016. Profits are expected to quadruple over the next five years, as opportunities for remote monitoring multiply. ‘We expect revenue to rise to €32.4 billion in 2021, boosted mainly by CRM and sleep therapy, but also medical adherence, glucose level, telehealth and other monitoring devices,’ Frick predicted.

Patients with chronic welfare diseases such as obesity, diabetes and hypertension represent the core of remote monitoring users and could potentially use the technology for other diseases related to their condition. The elderly are also increasingly using monitoring devices, as the world population grows older. However, since many of this group have never owned or used tablets or mobile phones, companies should worry about developing appropriate strategies, Frick pointed out. ‘Technology and user interfaces are becoming better and better. Companies that want to be, and stay, on top need to provide good user interface and user experience,’ he said. Non-prescribed monitoring and healthcare consumerism could also help boost sales in this sector, he predicted. ‘People today use equipment that could track their activities, their weight, their blood pressure, etc. Because of this, when people, by any reason, become patients, they are already pretty used to track and measure themselves, and the threshold for using medical graded tracking equipment is much lower than otherwise.’ The market should continue to grow under the impulse of clinical trials requiring increased monitoring, incentives from insurance companies and payers, national health systems supporting remote monitoring and new clinical evidence based on cost effectiveness.

Data in the cloud

The biggest trend in the market now is connectivity: meaning equipment used by the patients is connected to a server or the cloud. The patients are also likely to use more and more their own tablet or phone for remote monitoring. ‘The trend that we see is that more and more equipment will use the patient’s own cellphone, tablet, etc. to connect the medical equipment to the server or cloud,’ he said. As health-related apps and devices generate potentially huge amounts of data, and this data becomes increasingly shared with third parties like clouds, privacy and protection will remain major concerns for the industry. ‘When the line between medical devices and health gadgets becomes blurred, traditional companies and start-ups try to position themselves as important stakeholders in the mHealth data ecosystem. National personal health records systems; device manufacturing companies, and independent app producers and tech giants such as Google, Apple and Microsoft are common options for data storage. ‘One trend is to share data in third party clouds. It’s important,’ Frick concluded, ‘for end-users, doctors and care giving institutions to choose a place where as many standards as possible are respected, and where it is as easy as possible to export the data.’

Profile:

Anders Frick is a Senior Analyst with a Media Technology Master’s degree from Linköping University and a Technology Management MBA degree from National Chiao Tung University. His areas of expertise include IoT, smart homes and mHealth. Before being an analyst, he was a journalist for over a decade, covering technology, economy and innovation.

28.08.2017