Demand for Rapid Results, Non-invasive Methods and Automated Monitoring

Frost & Sullivan finds healthcare infrastructure modernization in developing nations and expanding application scope boosts opportunities for POCT

Frost & Sullivan is carefully tracking the transforming global point-of-care testing (POCT) market, offering latest information on key opportunities and critical unmet needs by region

Identifying in vitro diagnostics (IVD) companies likely to strongly emerge in each POCT segment is a vital result. Key changes in policy and regional market trends provide insight into the future of POCT and, more importantly, outline game-changing strategies for market participants to succeed.

The newly released Global Point-of-Care Testing (POCT) Market analysis finds the global market earned $5.32 billion in 2012 and estimates this to reach $9.02 billion in 2019 at a compound annual growth rate of 7.9 percent. In addition to quick turnaround times and its role in preventive healthcare, the uptake of POCT is fuelled by the capability to easily integrate with emerging healthcare IT enabling higher value.

This analysis is part of the Frost & Sullivan Life Sciences Growth Partnership Service program. It provides a comprehensive, global analysis of point of care (POC) tests for blood glucose, HbA1C, cholesterol, blood gas and electrolytes, drugs of abuse, infectious diseases, pregnancy, haematology, and urinalysis, among other areas. The study also details market drivers and restraints; revenue forecasts and major market trends; political, economic, social and technology analysis; as well as a competitive and market share analysis for the total POCT market and each product segment within the United States, Europe, Asia and Australia.

Manufacturers globally continue to focus on areas in which near-patient diagnosis and monitoring can profoundly change therapy decisions, improve outcomes, and lower costs. Market participants are strengthening their R&D focus for the development of highly sensitive biosensors, less expensive optical systems, and non-invasive systems to integrate into POCT instruments for better performance. Microfluidic systems based on the lab-on-chip concept, along with increased biomarker discoveries of equipment, may cause a paradigm shift in the clinical diagnostic industry.

POCT is gaining traction due to increasing incidence and prevalence of lifestyle diseases such as diabetes. POC HbA1C tests are routinely performed for type 1 and 2 diabetes patients and their proven efficacy encourages continued adoption by doctors. For instance, in most European countries, these tests are included as part of a routine in a comprehensive screening programme to monitor blood sugar level. Doctors and diabetes specialists recommend HbA1C tests once every three months, helping sustain test volumes.

“The slowly but steadily growing trend towards automation in emerging countries is likely to provide future opportunities for market growth as laboratories and hospitals focus on modernisation,” said Frost & Sullivan Healthcare Senior Research Analyst Srinivas Sashidhar. “The market will also be propelled by the higher number of new products and increased patient awareness of diagnostics.”

However, the cost per unit of POC tests is higher than that of central laboratory tests. Other cost factors include the impact of reduced turnaround time, the overall cost of care, the workflow on clinical units, the length of patient stay, and costs of all consumables. Since the overall cost of consumables for POCT is higher than the cost of tests performed in an automated laboratory, there will be hesitation in opting for POC tests, in spite of clear advantages such as immediacy and ease-of-use.

To combat this challenge, healthcare providers and third-party payers must be made aware that the additional costs per test at the POC for the rapid evaluation of patients can lower the overall healthcare delivery cost.

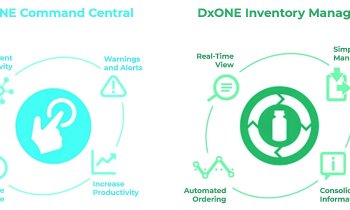

“POC test manufacturers may also look to partner with IT vendors to facilitate enhanced POCT data management,” noted Sashidhar. “This will facilitate automated systems for discrete, time-bound or continuous monitoring. It requires no supervision and will automatically cater to critical patients and notify the relevant medical caregiver.”

About Frost & Sullivan

Frost & Sullivan, the Growth Partnership Company, works in collaboration with clients to leverage visionary innovation that addresses the global challenges and related growth opportunities that will make or break today's market participants.

10.09.2013