Bright outlook for cardiovascular monitoring equipment in Europe

Technologically advanced, cost-effective cardiovascular monitoring systems are increasingly in demand in Europe. New analysis from Frost & Sullivan point out that the market will grow from $350.0 million in 2007 and to $491.3 million in 2014.

Increasing demands in cardiovascular monitoring equipment will spur the market.

"Lifestyle changes and an ageing population underpin the increasing incidence of cardiovascular-related illnesses," notes Frost & Sullivan Research Analyst Gideon V. Praveen Kumar. "These trends contribute to an increased need for diagnostic cardiovascular monitoring equipment market in Europe."

A new analysis from Frost & Sullivan concludes that the European market will be fired. While in 2007 the revenues add up to $350, it is estimate to reach $491 million in 2014. The desire for sophisticated, yet easy-to-use equipment at affordable rates will offer market participants considerable growth opportunities in this sector.

Cardiovascular diseases are one of the leading causes of premature death. In Europe alone, about $160 billion is being spent annually on the diagnosis, treatment and rehabilitation of patients with cardiovascular diseases.

Furthermore, statistics have revealed that one in five teenagers suffers from the early signs of heart disease. Under such circumstances, diagnostic cardiac monitoring systems are finding wider application in hospitals and cardiac rehabilitation centres to enable effective diagnosis and therapy.

ECG is a well-established procedure, however there have not been significant technological breakthroughs in recent years and the market continues to persist with old technologies. This situation has been exacerbated by the lack of funds for the research and development of innovative technologies. In addition, the focus on treatment, rather than monitoring modalities, is threatening to impede market momentum.

"Larger participants have always had the upper hand because of their reputation and the superior brand awareness that they have been able to create," adds Kumar. "This is threatening the survival of smaller competitors."

Despite intense competition, growth opportunities exist for companies that form strategic alliances to meet evolving end-user demands. Market expansion will be sustained by technological enhancements that promote greater user friendliness and improve networking and communication capabilities, while supporting cost efficiencies.

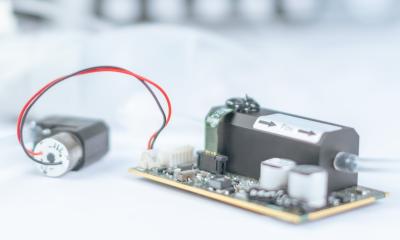

Photo: GE Healthcare29.07.2008

More on the subject: