A third of European hospitals report operating losses

Nearly half of 1,522 hospitals studied are potentially “at risk” of defaulting on financial commitments.

Facing rapidly rising costs, a third (33 percent) of European hospitals are reporting operating losses, generating negative earnings after tax, according to a new nine-country study released by Accenture at the annual WoHIT Conference.

Accenture‘s European Hospital Rating Report includes an in-depth review of the 2011 financial statements of more than 1,500 hospitals in nine countries: Austria, Belgium, France, Germany, Italy, Norway, Portugal, Spain and Switzerland.

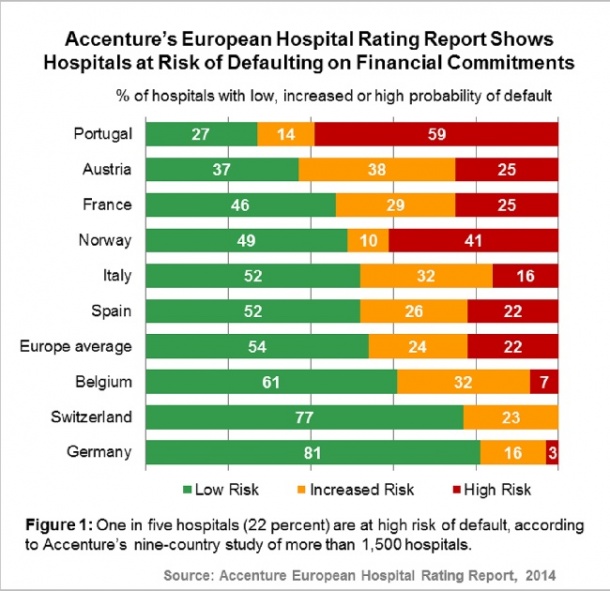

The study assessed three factors: hospitals’ creditworthiness, the probability of defaulting on financial commitments and operating profitability. Accenture determined the proportion of hospitals, in each country, with a “low, increased or high risk of default,” and found that nearly half (46 percent) of the European hospitals studied are potentially at risk of defaulting on their financial commitments, such as paying vendors for hospital services.

“Many hospitals are placing a high level of financial strain on their national health system, which is unsustainable for the future,” said Kiryakos Chebel, managing director of Accenture’s Health business in France. “Hospitals need to be as vigilant as commercial enterprises in managing their finances to ensure the stability of their clinical practice.”

The research also shows nearly half (46 percent) of French hospitals are considered to be “low risk,” in terms of their probability of default, as they can meet their financial commitments, but a quarter were rated as “high risk.” Still, this compares favorably to the proportion of hospitals in Portugal (59 percent) and Norway (41 percent) that could face a “high risk” of default.

Beyond an institution’s ability to meet its financial commitments, hospitals with a higher-earnings margin (EBITDA[1]) are able to fund investments through their operating cash flow. While France had the second highest operating profitability of the countries studied, averaging an EBITDA margin of 10.7 percent, roughly half of its hospitals still had some risk of default, suggesting they could have insufficient cash flows to cover deficits. In contrast, Italy reported the highest operating profitability overall, generating an EBITDA margin of 12.1 percent, or nearly four times the level of neighboring Switzerland. And, although 48 percent of Italian hospitals face some degree of financial risk, only 16 percent are considered “high risk.”

“If the financial management of French hospitals remains unaddressed, citizens within the same country could face significantly different standards of care over time or even see local hospitals having to close,” Chebel said. “We still have time to prevent a troubling situation from becoming a crisis, but hospitals must establish business models that will secure a firm financial footing for the future.”

Methodology

The Accenture Hospital Rating Report was conducted to assess the financial performance of Europe’s hospital market. In collaboration with RWI, Accenture examined the 2011 public financial statements of 1,522 hospitals, accounting for 30 percent of the entire hospital market in the nine countries studied: Austria, Belgium, France, Germany, Italy, Norway, Portugal, Spain and Switzerland. Although not equally represented, the sample is comprised of public and privately owned hospitals with the exception of one country, Spain, which included only private hospitals, as sufficient public hospital data was not publicly available.

The study assessed hospitals’ creditworthiness, probability of default and operating profitability. An Accenture classification model, adapted from the MORE rating classes, provided an assessment of the creditworthiness of these hospitals based on a balance sheet and profit and loss analysis. The analysis calculated two key measures: the probability of default, which is the likelihood that an organization will not meet its financial commitments, and EBITDA (earnings before interest, tax, depreciation and amortization) margin, which implies an organization’s approximate operating cash flow, or operating profitability.

04.04.2014