One third of German hospitals are in the red

Government grants €1.1 billion to help finance rising personnel costs and increase nurses specialists in infection prevention and control

The closure and consolidation of German hospitals over the past few years was a politically endorsed and necessary act to cut back on overcapacities and inefficiencies in the healthcare sector.

Hospitals were confronted with an ever increasing number of cuts and limitations, to an extent where even university hospitals and formerly profitable clinics are now sliding deeper and deeper into the red, without being able to do anything about it.

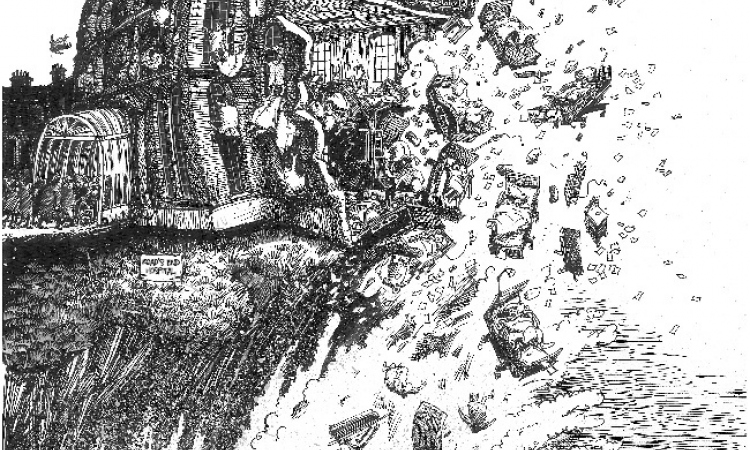

Thus, for quite some time, there has been resistance from German hospitals and among their 1.1 million employees against that policy. The German Hospital Federation (DKG) is vehemently fighting developments – with one campaign under the banner All of us are the Hospital. ‘When around 700 out of 2,000 national hospitals treating around six million patients and with 300,000 employees affected, are in the red, then this is a problem of national importance, which does not permit further cuts and must be addressed quickly,’ Alfred Dänzer, President of the German Hospital Federation, emphasises.

Structural underfunding

Mark Schreiner, head of European Politics and Healthcare Industry at the DKG, sees several specific factors that place a financial strain on hospitals. ‘There’s a problem with structural under-funding, such as the coupling of cost increases in the hospital sector being linked to the cost orientation rate, insufficient financial investment in hospital infrastructure on the part of the Bundesländer, increasing bureaucratic expenditure, and legal cutbacks,’ he explains.

During the 16th legislative period (2005-2009) the German legislator decided to replace the basic wage with a cost-oriented rate, but this change of paradigm, envisaged for 2013, has yet again been postponed.

The cost-orientation rate is determined by the Federal Statistical Office and shows what general cost increases are on the horizon, while the basic wage rate shows the average increase in agreed wages. Although 60% of hospital costs are personnel related, there are further cost drivers, such as increasing energy costs resulting from the German Renewable Energy Act contribution and also the increased bureaucratic expense caused by documentation obligations, along with increased expenditure on liability and investments. ‘These costs exceed the maximum level of cost increases that the hospitals were allowed, based on the cost orientation rate by far,’ Mark Schreiner points out.

Because the way in which diagnosis related groups (DRGs) are financed does not cover all costs, right from the word go there are funding gaps that hospitals must offset through more efficient economic operation and an increase in the volume of individual services provided. Mark Schreiner is optimistic that, with the help of a revised cost orientation rate, in the future it will be possible to show more realistically the price increases that must be set with health insurers. ‘We expect an improvement in the financial situation and are optimistic that the revised cost orientation rate will soon be set. The reserves of around €30 billion built up by the statutory health insurers are unlikely to be structurally affected by this,’ he points out.

He sees the Bundesländer’s lack of investment as far more severe. With Germany’s dual financing system, where health insurers finance treatment costs and the Bundesländer finance infrastructure costs, an investment backlog runs to billions of euros – certainly a double-digit figure. Comparison: Whilst the national rate of investment is 18.2%, the figure is only 4.4% for the hospital sector. ‘This is demonstrably not sufficient investment funding. Last year alone, expenditure fell by another 1.4% to €2.7 billion. We can see a political to and fro between the Federal government and the Länder, with both sides reminding each other of their responsibilities.’

Therefore, in many hospitals there is a trend to fund investments in infrastructure out of their own pockets, thus also increasingly saving on labour, which pushes the remaining staff to the limits of their capacities. ‘An increasing number of hospitals have their backs against the wall. We need more financial means to invest in staff and we need reliable investment funds,’ demands Mark Schreiner, speaking on behalf of the German Hospital Federation.

Government grants cash injection

This request appears to have been partly granted: On 7 April the Federal Cabinet decided on a cash injection of €1.1 billion for hospitals for this year and the coming year to help finance rising personnel costs and additional infection prevention and control nurses. Deficits caused by hospitals treating more patients than agreed are due to be offset by a new allowance. However, Daniel Bahr, Federal Minister of Health, who continues to put the onus on the Länder governments, said: ‘I appeal to the Länder to also meet their obligations to fund investments.’

13.05.2013